ABSTRACT

A great disturbance in the Energy mix in the World is already happening and it will accelerate during the next ten years.

This will result in a curbing of the demand for Oil, an increase in the demand for Natural Gas, a shrinkage of the use of coal and a great increase in renewable sources of Energy.

This is happening because of multiple pressures on the Energy mix.

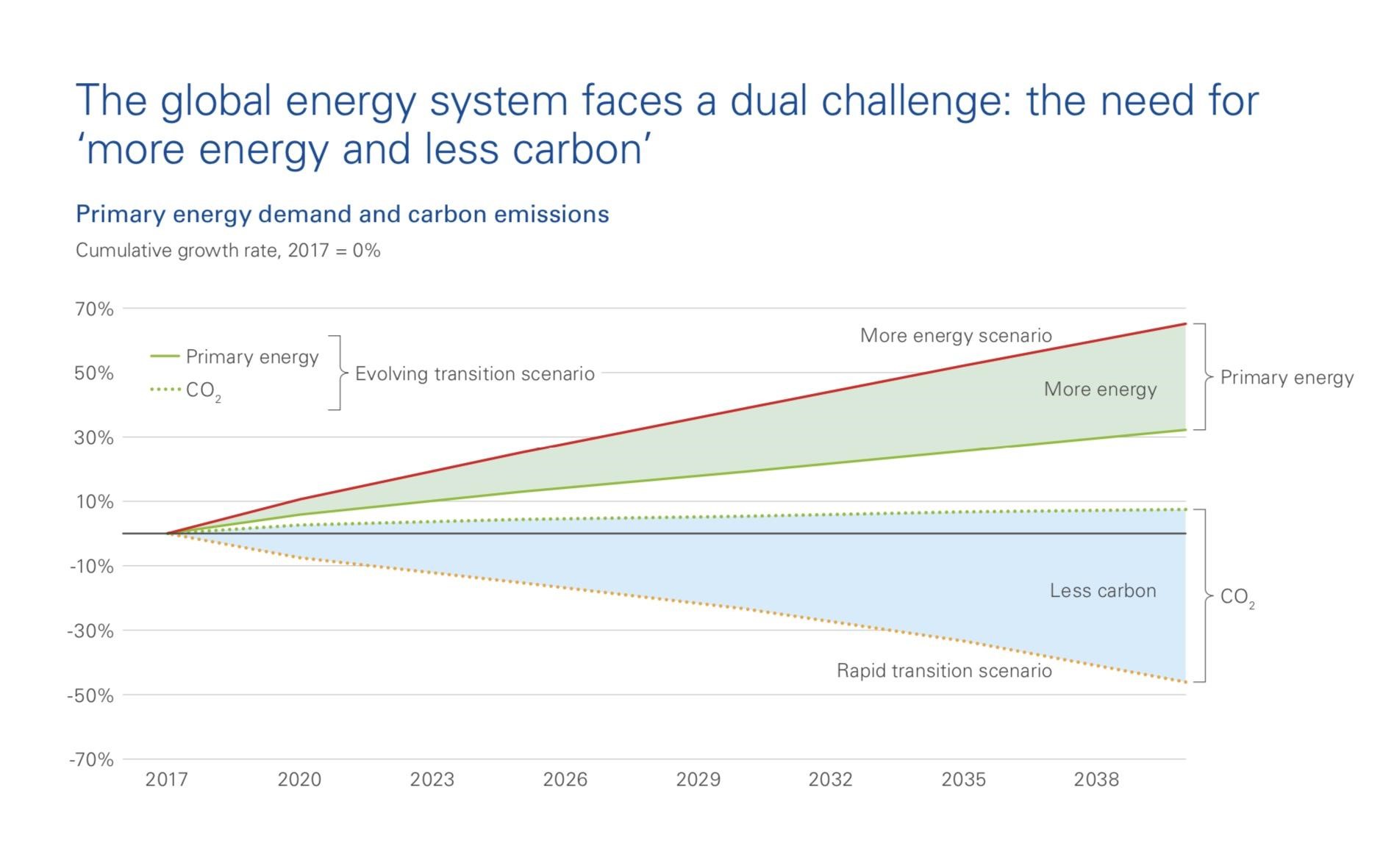

As BP expressed it: “The global energy system faces a dual challenge: The need for more energy and less carbon”.

The three principal parameters linked to the above challenges are:

- Climate change and pollution.

- The emergence of economically competitive renewable sources of Energy.

- The electrification of Transport.

The combination of all three above parameters is pushing down the demand for Oil.

Additionally:

The US have taken the Geo-economics Strategic decision to produce and export as much Hydrocarbons as possible, because they consider that Hydrocarbons are a legacy Energy source, to be replaced in the near future by other Energy sources with emphasis on renewables.

China has taken the Geo-economics Strategic decision to electrify all its Transport, mainly because of City pollution, due principally to Hydrocarbons use in Transport.

Both decisions indicate a dramatic change in the demand for Oil.

The curbing of the demand for Oil, is going to greatly affect the balance of the World Economy, with the Middle East suffering the most, in spite of important reserves of Natural Gas in some of its Countries.

INTRODUCTION

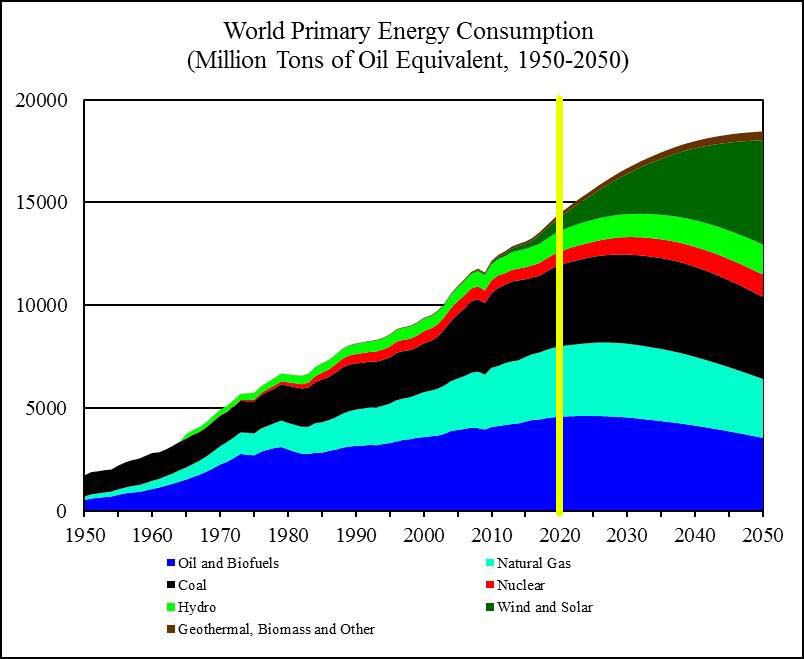

The above graph is a reasonable estimate of how Energy consumption will evolve in the next 30 years.

But a 30-year extrapolation is of uncertain value, as the projection is too long for any accuracy in the predictions.

In this essay we concentrate on the possible World Energy demand evolution for the next 10 years, focusing on Hydrocarbons, as Hydrocarbons are also a major factor in the World Economy.

A number of important factors, as analyzed below, drive significant disruptions in the demand for Hydrocarbons.

For the last 100 years two were the indisputable facts about Hydrocarbons:

- The first was that the principal source of Hydrocarbons was the Middle East

- The second was that in a point of time in the future, the World would reach the production peak, which is the point that production just matches demand and past this point, World production will be less than the World demand in Hydrocarbons.

In the last five years the validity, of both “indisputable facts” above, is questioned and the great hydrocarbons disruption has started.

Five are the principal new parameters:

- The decrease in demand for Oil worldwide.

- The emergence of the US as a net Hydrocarbons exporter instead of the major Hydrocarbons importer that was up to now.

- The emergence of renewable sources of Energy in an economically competitive way

- The Climate Change

- The electrification of Transport.

The Middle East is not the principal source of Hydrocarbons anymore.

The Middle East produces now about ⅓ of the World’s Oil and about ⅙ of the World’s Natural Gas.

Both numbers are challenged by the dramatic increase of US Hydrocarbon production and exports, due to the new fracking technologies. Hydrocarbons are also found in other areas of the World such as the North Pole and East Med.

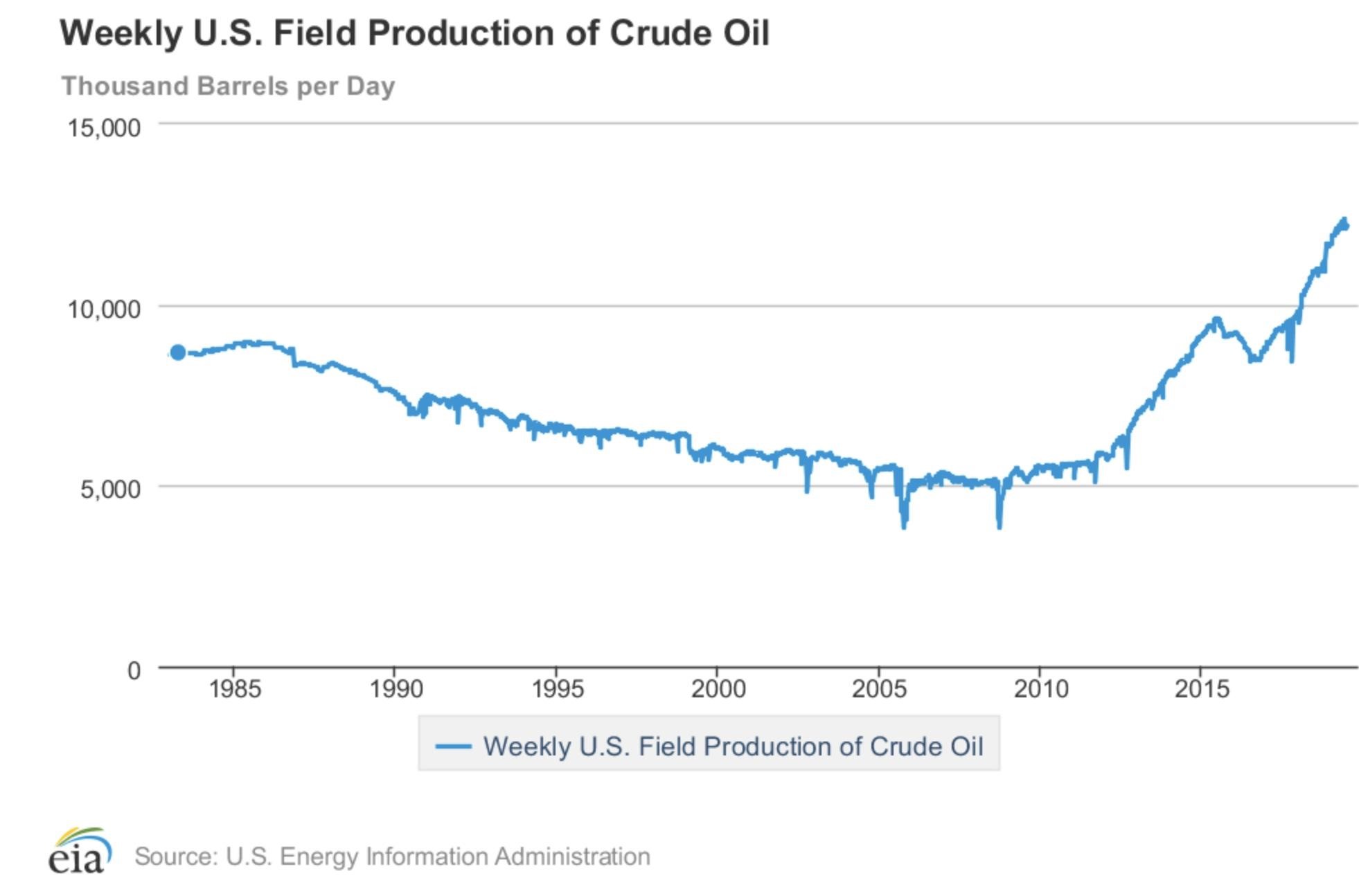

The United States took, this Century, the Strategic decision to consider Hydrocarbons a legacy source of Energy and proceed to their maximum exploitation and exports before they are replaced by other sources of Energy, mainly renewables.

The country now gets 75% of its Oil from domestic sources. (It was only 35% ten years ago.) and is a net exporter of Natural Gas.

Allies and rivals, however, continue to depend on Middle Eastern oil for a significant proportion of their energy needs. This will not last forever either.

For Geopolitical and Geo-economics reasons, these Countries also wish to reduce their dependence on Middle East Oil.

The United States produced in June 2019 an all-time record of 12.4 million bpd.

As Oil Price noted:“it stripped OPEC and Russia of some of a nice chunk of oil market clout”.

For as long as fracking technology improves and become more profitable and renewables increase their share in Energy production, the US is going to become the biggest Oil exporting Country, as it already is the biggest Oil producing Country in the World.

Threatened by American exports, Russia has agreed with Saudi Arabia to extend by six to nine months a deal with OPEC on reducing oil output, as oil prices come under renewed pressure from rising US supplies and a slowing global economy.

This is countered by surging U.S. supply as well as gains from Brazil, Canada and Norway which will contribute to an increase in non-OPEC supply of 1.9 million bpd this year and 2.3 million bpd in 2020.

It must be noted here that US production is almost 1.2 million barrels per day higher year on year—the equivalent of OPEC’s production cut agreement.

Production cuts cannot be sustainable for long periods. Any effort to hitch the price of Oil up will result in a destruction of Oil demand, as alternative Energy sources become economically more competitive.

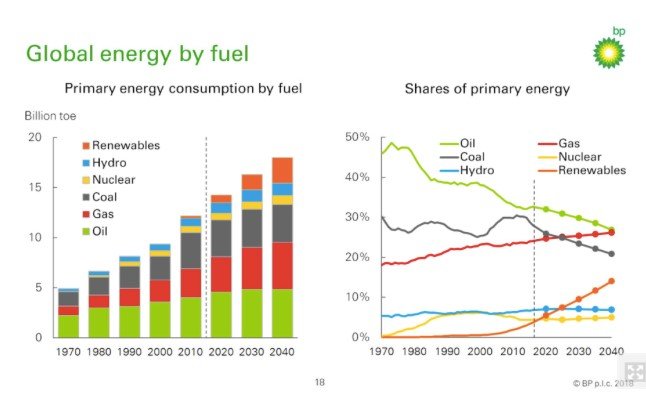

Global fossil fuel consumption over the long-term

The 20th century saw a large diversification of fossil energy consumption, with coal declining from 96 percent of total production in 1900 to less than 30 percent in 2000. Today, crude oil is the largest energy source, accounting for around 39 percent of fossil energy, followed by coal and natural gas at 33 and 28 percent, respectively.

Those figures, with the exception of natural gas are going to be dramatically revised downwards.

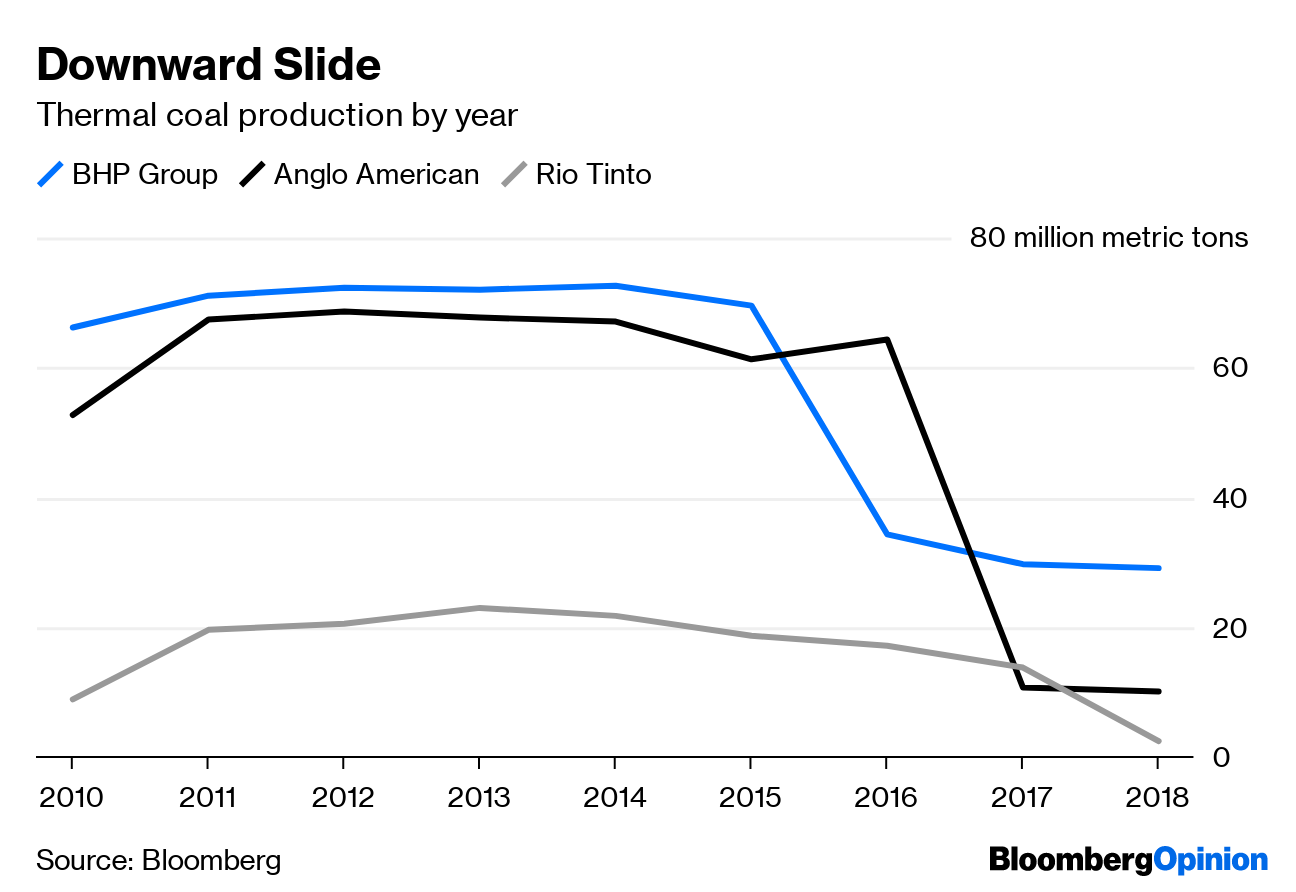

COAL

A major milestone has been passed this year.

For the first time in its history, in April 2019, renewable energy’s share of total available installed in the U.S. generating capacity reached 21.56%. By comparison, coal’s share dropped to 21.55%.

Although installed capacity does not equal produced electricity, the trend is clear in the US and Europe, both voracious Energy consumers. Coal is on its way out.

The elephant in the room regarding coal consumption is China. Coal is still 60% of China’s Energy production, down from 70% ten years ago but it is dropping slowly.

Significantly, China plans to replace coal by Natural Gas, nuclear and renewables but not Oil, the consumption of which will be further reduced.

It is significant that big Insurance Companies started refusing to insure coal producing or coal using Companies.

OIL

The future of Oil is not as strong as its past. This is a market where 1% increase in overproduction can create a 10% drop in the price of Oil, and 3% overproduction can create panic and demolish Oil prices.

Year-on-year increases are “grinding to a halt” across March and April for eight early-reporting countries, including China, India and the US.

This is significant because the above three countries account for 70% of the world’s oil demand growth this year.

Oil demand growth estimates for 2019 have been cut.

According to PwC, Global oil demand grows at a slower pace of 0.5% p.a. from 2020 until its peak in 2033, due to decreased road transportation consumption. We believe that the peak will come earlier.

Last year’s oil demand growth estimate has been revised downward by 70,000 barrels per day (bpd) to 1.2 million bpd, while the forecast for this year is cut by 90,000 bpd to 1.3 million bpd, the IEA said.

By it was estimated that in 2030, oil demand could hit a peak and then enter decline. This is likely to happen earlier.

For the next very few years, oil demand should continue to grow, although at a slower and slower rate. According to Bank of America Merrill Lynch, the annual increase in global oil consumption slows dramatically in the years ahead. By 2024, demand growth halves, falling to just 0.6 million barrels per day (mb/d), down from 1.2 mb/d this year.

China’s oil consumption will peak in 2025, five to eight years earlier than market consensus, according to Morgan Stanley.

Most analysts agree that the maximum limit for Oil demand is 2030, after which demand growth zeros out as consumption hits a permanent peak, before falling at a relatively rapid rate thereafter.

The main driver of the destruction in demand is the proliferation of electric vehicles.

Even if a Geopolitical event creates a temporary Oil scarcity, that will only accelerate the disengagement from Oil of the World’s Economy.

OECD stated that high oil prices result in “demand destruction”. If high prices last long enough, other Energy sources are adopted much faster.

As Gerard Reid observed “The Elephant in the room is Energy used for heating”.

As IEA note 50% of all Energy consumed is used to produce heat.

Heat is produced mainly by fossil fuels. Oil use for heating purposes can easily be replaced by Natural Gas and this is underway. Coal can be replaced by Natural Gas but it is more complicated. Electricity is the ideal replacement from the pollution control and other points of view but the expense involved is enormous.

However, this presently works to the detriment of Oil demand and the increase of the Natural Gas demand.

As a last observation, Oil demand, great or small is linked to economic growth.

Central Banks in the whole world strive to stimulate demand through lower interest rates and easy money. This scheme will eventually collapse taking Oil with it for a period.

All indices converge to show that Oil is past its prime as a main Energy source.

The drop-in demand will be noticeable before 2030.

NATURAL GAS

The World demand for Natural Gas is on the rise. Natural Gas is the major winner from the reduction of the use of coal.

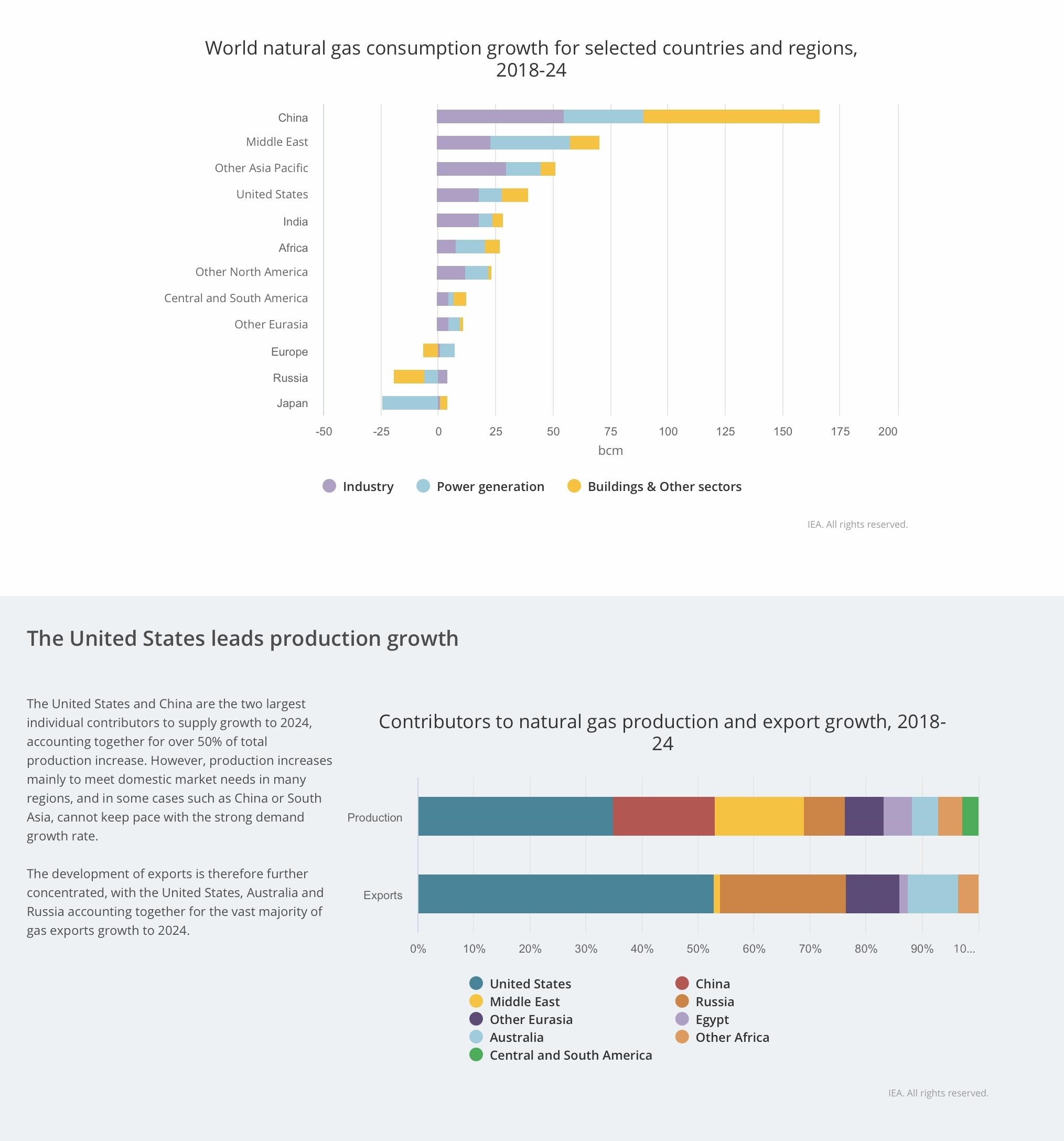

The schemes below, taken from IEA Gas 2019 report are self-explanatory.

It is obvious that Natural Gas is the emerging and very broadly spreading source of choice of Hydrocarbon Energy.

As the report points out, the major consumer is China and Natural Gas is preferred to Oil as a replacement for coal.

It is interesting to note that a major Hydrocarbons producer Saudi Arabia its using Natural Gas more in the domestic markets than for exports.

The United States, using advanced fracking technology are rapidly becoming a major Natural Gas exporter, both by pipeline and through LNG terminals.

Both production and 4xports are impressively growing in the US.

Climate Change threat

As BP notes in its BP Energy outlook 2019 edition: “The global energy system faces a dual challenge: the need for <more energy and less carbon>”.

This Energy demand has already created major problems in the Planets which increase dramatically every year.

According to the UN, Climate crisis disasters are happening now every week.

UN Secretary General remarked in this year Osaka G-20:

“Climate change is running faster than what we are… We are seeing a multiplication of natural disasters that are becoming more intense, more dramatic, with worsening humanitarian consequences and more frequent.

And so, all the analyses that can be made, show the situation, in practical terms, is worse than what we could have forecasted and the political will has been failing. This is a paradox that needs to be addressed…

…that is the reason why I will be appealing to the leaders here in relation to a much stronger commitment of their countries for climate action, and there are many aspects of that that are absolutely essential on this: putting a price on carbon, ending subsidies to fossil fuels, not accepting the idea that we still have an acceleration of the construction of coal power plants…”.

CO2 levels in the atmosphere will reach in 10 years the 450ppm threshold, the point at which significant portions of the planet’s ice will melt away.

Most of it is due to the use of fossil fuels.

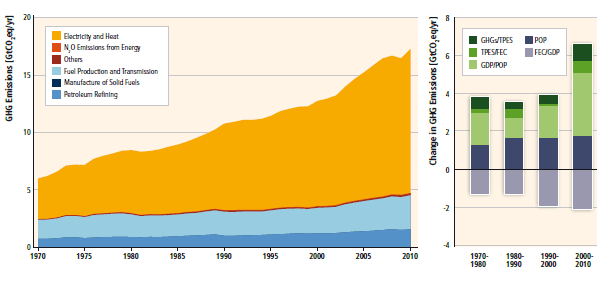

According to the IPCC report from 2014, the energy supply sector accounted for almost 50% of all GHG emissions, making it the largest contributor to global GHG emissions. Despite the Kyoto Protocol, GHG emissions of this sector increased 36% between 2000-2010, where the major contributors were CO2 emissions from Coal (43%), Oil (36%) and Gas (20%).

Moreover, the report emphasizes that transport is another important sector which contribution accounts for almost 23 % of total energy-related CO2 emissions. To reduce the effect of this sector on carbon emissions, it is necessary to lower the energy intensity by enhancing vehicle and engine performance and substituting oil-based products by natural gas, bio-methane, biofuels or hydrogen.

The recent heat waves in the World have shown another dramatic aspect of the Climatic change. Unbearable for human’s heat, which is fast approaching in many parts of the planet.

The graph below shows clearly the acceleration in the rise of temperature of the Planet.

The Bank of England requires companies to consider how certain climate-related scenarios would affect their business, each with transition risks as economies decarbonize and meet the climate targets of the Paris Agreement and physical risks.

It is obvious that the dire consequences of Climatic change will force abandonment of fossil fuels faster than Governments are ready to do it.

The emergence of renewable Energy sources.

Seven recent examples illuminate the situation better than any long analysis.

- “I am excited to announce a new 2 gigawatt (GW) solar project in Al Dhafra region here in Abu Dhabi. This will eclipse the record-breaking 1GW Noor Abu Dhabi Plant”, stated in June of this year Dr Thani bin Ahmed Al Zeyoudi, Minister of Climate Change and Environment.

Noor Abu Dhabi, the world’s largest solar project, with 3.2 million solar panels and a capacity of 1,177 megawatt (MW), just started commercial operation. - The Los Angeles Department of Water and Power (LADWP) Board of Commissioners is expected to approve a two-phase 25-year power purchase agreement (PPA) priced at 1.997¢/kWh for 400 MWAC / 530 MWDC of solar electricity, and 1.3¢/kWh for electricity from a 400 MW / 800 MWh energy storage system.

- General Electric will demolish a California natural gas-fired plant with 20 years remaining in its useful life, deeming the plant “uneconomical” as inexpensive solar and wind take a larger share of power in the state. It will use the area for the installation of batteries for solar energy storage.

- The Energy Information Administration (USA) announced that wind, solar and hydroelectric generated nearly 68.5 million megawatt-hours of power in April, while coal only generated 60 million, Bloomberg News reported.

- In the UK, according to National Grid, 47.9% of electricity across the first five months of 2019 came from wind, solar, hydro, storage, and nuclear, while fossil fuels only supplied 46.6%.

Through the first three months of this year, Scotland generated 88% of its electricity from renewables. - Not many Countries approach this record but the trend is clear.

- It is planned that renewable energy should account for at least 40% of India’s installed power capacity in 2030.

The electrification of Transport

The change from ICE cars to EVs is becoming a race. Low sales of ICE cars Worldwide combined with continuously stiffer emissions regulations and trade restrictions are forcing the pace.

Carmakers seeing profits dropping are closing conventional production units and slashing jobs to make available Capital to invest in electric cars.

The International Energy Agency 2019 edition of the Global electric vehicles outlook highlights the following:

EV adoption is increasing at a rapid pace. In 2018, the global EV fleet exceeded 5.1 million from 2 million in 2017. It is still rapidly increasing as most automobile producing companies worldwide are heavily investing in EV.

Policies play a critical role. Leading countries such as China, the US and Norway use a variety of measures such as fuel economy standards, incentives for zero- and low-emissions vehicles, support for EV charging infrastructure and economic instruments that help bridge the cost gap between electric and conventional vehicles.

Technology advances are delivering substantial cost cuts.

The EV uptake and related battery production requirements imply bigger demand for new materials in the automotive sector, requiring increased attention to raw materials supply.

The global stock of electric two-wheelers was 260 million by the end of 2018 and there were 460 000 electric buses.

The global total for light-duty vehicle chargers reached 5.2 million (540,000 of which are publicly accessible), complemented by 157 000 fast chargers for buses.

EVs consumed about 58TWh of electricity (largely attributable to two/wheelers in China) and emitted 41 million tons of carbon-dioxide, while saving 36 Mt CO2-eq.

According to the IEA’s more conservative “new policies” scenario, sales of electric cars could reach 23 million in 2030, with the global stock – excluding two and three-wheelers – topping 130 million. Under the EV30@30 scenario, sales could reach 43 million to take the global fleet to 250 million.

The almost 100% difference between the two scenarios shows the uncertainty of EV forecasting, but all agree it will be a very dynamic growth.

In both scenarios, China would remain the largest market, with shares of 57% or 70% in 2030, respectively.

Mining and resources giant BHP has raised its projection for the uptake of electric vehicles, saying that electric vehicles could achieve more than 50 per cent share of global new vehicle sales by 2030, and 100 per cent of all vehicle sales by 2050.

There is clearly a dramatic paradigm shift in the use of Energy for Transport.

Users. shift toward electric cars and mass transport which is mostly electrified.

All this, also combined with increased efficiency of ICE means an important reduction of the demand for gasoline and diesel oil is soon to be banned in most Countries.

Conclusion

All the above converge in the conclusion that the demand for Oil will be diminished.

There are considerably differing estimates about the rate of reduction.

It is the writer’s opinion that this rate will accelerate every year during the next 10 years and the shift to cleaner sources of Energy than coal and Oil will increase faster than estimated.