In an age when everything is disrupted Supply Chain could not be the exemption.

The sensitivity of the Supply Chain, for the last twenty years, was dependent principally on financial, commercial or transport disruptions and Acts of God.

This is not the primary source of disruptions anymore.

A new and more damaging type of Supply Chain disruptions is emerging.

They are the regulatory ones and the worst are the Trade Wars.

In a recent case, where we were examining the sensitivity of the Supply Chain of a big  food corporation, we found out that we could almost always build in alternative sources of supply for most disruptions, except the regulatory and particularly the geopolitical ones.

food corporation, we found out that we could almost always build in alternative sources of supply for most disruptions, except the regulatory and particularly the geopolitical ones.

Globalization made possible truly internationalized Supply Chains. Countries and Companies that were off the supply map, became within a few years providers of significant components.

This is not only relevant for the recently emerged mega-suppliers of China and India.

There are UAE industries providing components to advanced technology firms in Germany, Malaysian Companies supplying high technology products to the US and South African Companies on which entire international food products depend.

This does not apply only to raw materials or finished products. The most complicated parts are components and sub-assemblies.

In reality, very few Companies are aware of their Supply Chain complex details and as a result have checked how many Countries and Companies are involved in the production of a sub-assembly or component from an OEM, necessary for the production of their respective final product.

The American administration’s move to limit access to American suppliers for Huawei has a more than a bilateral impact.

The same is valid for the two-year-old Chinese decision to introduce the Cybersecurity Review Regime or CRR. It practically means that arbitrarily, the Chinese Government may decide, at some point, that some product or component may not be bought or sold in China.

The same is valid for the two-year-old Chinese decision to introduce the Cybersecurity Review Regime or CRR. It practically means that arbitrarily, the Chinese Government may decide, at some point, that some product or component may not be bought or sold in China.

That may result easily to global material disruptions and financial losses for any multinational Corporation and even smaller Companies.

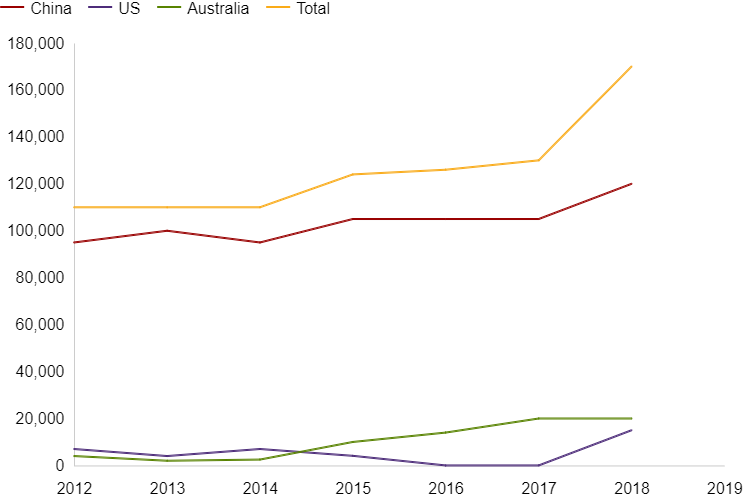

China’s hidden card in the trade war with Trump’s decisions is rare earth minerals. “Rare earths” as they are called, are 17 elements that are used in electronics, energy, aeronautical and defense industry. China is a monopoly, dominating the global market up to 70%. Rare earths are the reason for China’s penetration interest in Africa. According to BBC, 80% of rare earths used in the US originates from China. Companies such as Raytheon Co, Lockheed Martin Corp, and BAE Systems Plc all make sophisticated missiles that use rare earths metals in their guidance systems and sensors. Goldman Sachs suggested in a recent note, that a threat of disruption to Apple’s production process (due to possible China rare earths ban) of the new iPhone could be particularly high risk in this regard.

Image source: US Geological Survey. Link: https://www.bbc.com/news/world-asia-48366074

Many businesses worldwide must redesign their Supply Chain if they are to do Business either with China or with the USA and to reconsider their own dependence on supply chains that go through either Country.

This uncertainty will result in trade upheavals and a re-alignment of global economic relationships.

It is likely that this tariff war will continue and will involve other Countries as well.

Just one example:

The American administration imposed a 35% tariff on black Spanish table olives following complaints by American growers that Madrid unfairly subsidizes its industry. Black olives export is Spain’s 400 million USD business. The Supply Chain of pizza and salad manufacturers must be realigned but also some other, unknown yet, businesses must realign their Supply Chain, when Spain retaliates.

The European Union is about to confront the United States first in the WTO, with further tariff battles to follow. Which in turn leads to long-term implications of those battles.

A protracted trade war would almost guarantee a global realignment. Supply chains that run through both the U.S. and China would constantly be subject to disruptions, so global manufacturers would have to decide whether to pursue an America-centric or China-centric strategy.

A protracted trade war would almost guarantee a global realignment. Supply chains that run through both the U.S. and China would constantly be subject to disruptions, so global manufacturers would have to decide whether to pursue an America-centric or China-centric strategy.

What is happening to Spanish olives and other products is also happening to the digital business which is split between Google and Facebook technologies or Chinese WeChat and Baidu.

This is due to China and other Countries imposing restrictions on the internet which will affect many other software products as well.

On another dimension, during 2011 a heavy flood-hit Thailand and as a result, 25% percent of the world’s hard-drive manufacturing capacity was affected. Hard Drive Prices went up, dragging up the prices of PCs, laptops, and tablets among other things, and as a side effect, the number of sales went down. Contingency plans for disasters or change of politics is a must, however, one solution doesn’t fit all. It’s a multi-factor game with many players. Have you ever played a chess game with more than 2 players?

A new Strategy for Supply Chain Management is required.

This is too big a subject, to be described in detail here.

Broadly thinking, it requires a sensitivity analysis with more emphasis to a geo-economic scenario and the design of alternative supply sources with new parameters introduced where even sales policies may affect the Supply Chain.

Whether the Supply Chain is managed in-house or subcontracted in part or in whole, a deep and timely examination of its structure is required.

The regulatory decisions resulting from Political considerations will affect businesses as never before.

The regulatory decisions resulting from Political considerations will affect businesses as never before.

Businesses must learn to jump over new barriers. In the Supply Chain redesign, there is a clear case where digitalization and use of customized algorithms provide superior solutions.